Use SEPA for simple and secure transfers in Euro

Secure, transparent, and efficient online business banking

Secure, transparent, and efficient online business banking

The Single Euro Payments Area (SEPA) is a financial initiative created by the European Union to make euro payments as simple and safe as domestic transfers. It connects banks and financial institutions across participating countries into one unified network for euro transactions. A SEPA bank transfer allows individuals and businesses to send and receive money within the SEPA zone using a standard account format known as IBAN. Funds move directly between banks in euros, avoiding currency conversions or international wire fees.

With SEPA, the same payment standards apply across all member countries. The system SEPA covers not only EU nations but also countries like Norway, Switzerland, and the United Kingdom. Transfers are processed electronically through automated systems, giving users fast and secure access to their funds across borders.

Unlike traditional systems, SEPA payments are designed for everyday euro transactions, making international euro transfers as simple as sending money to a local account.

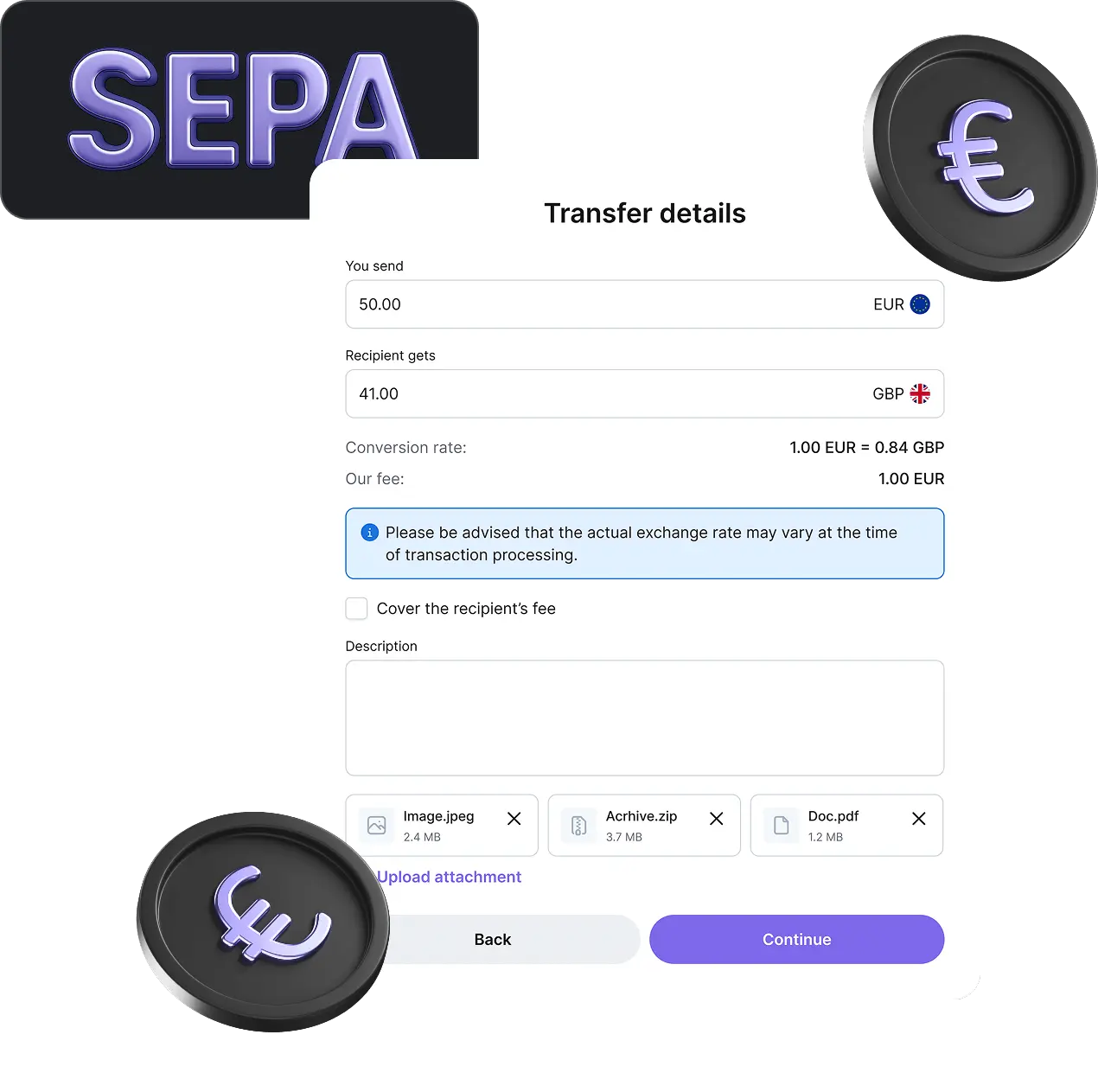

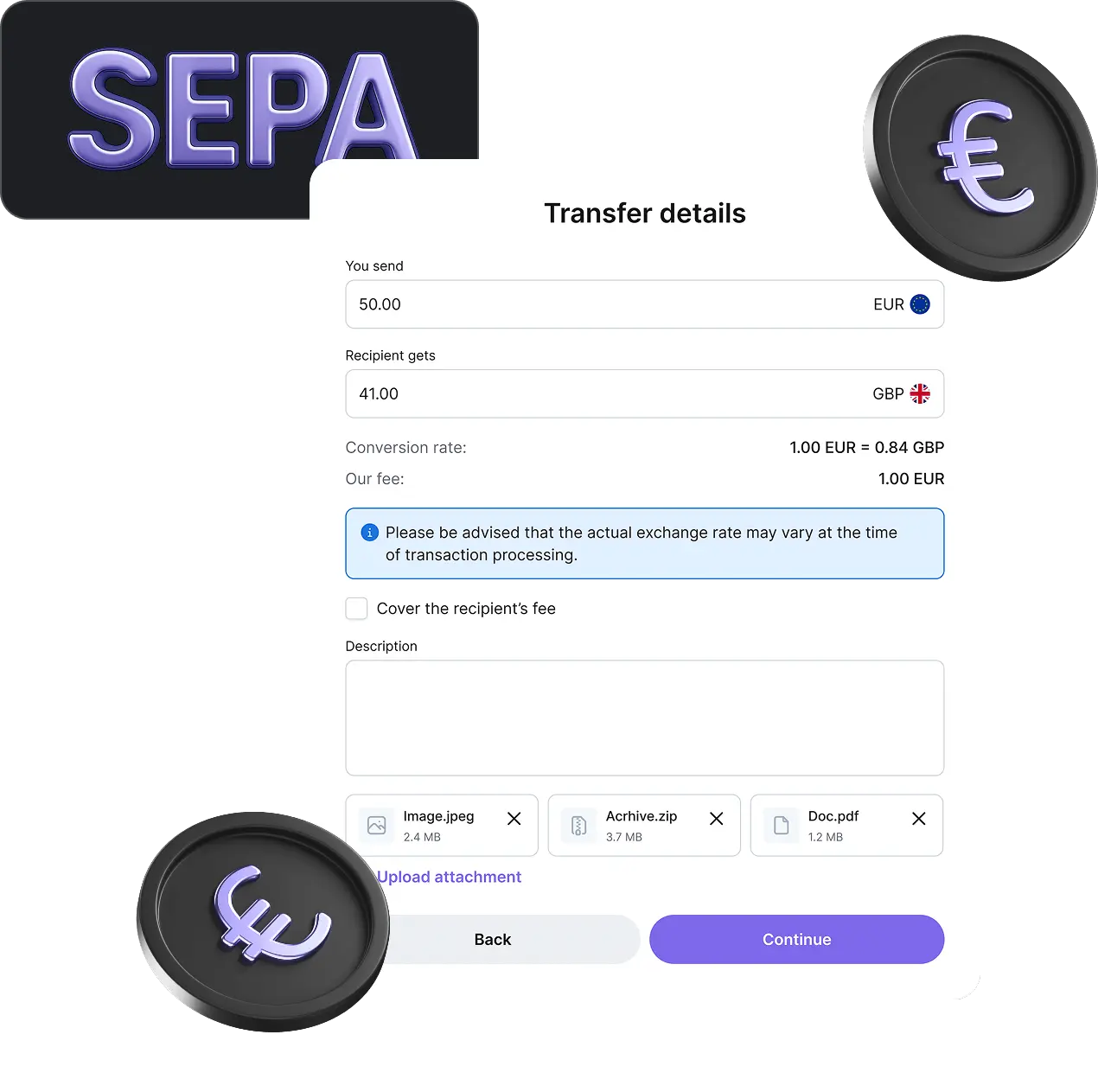

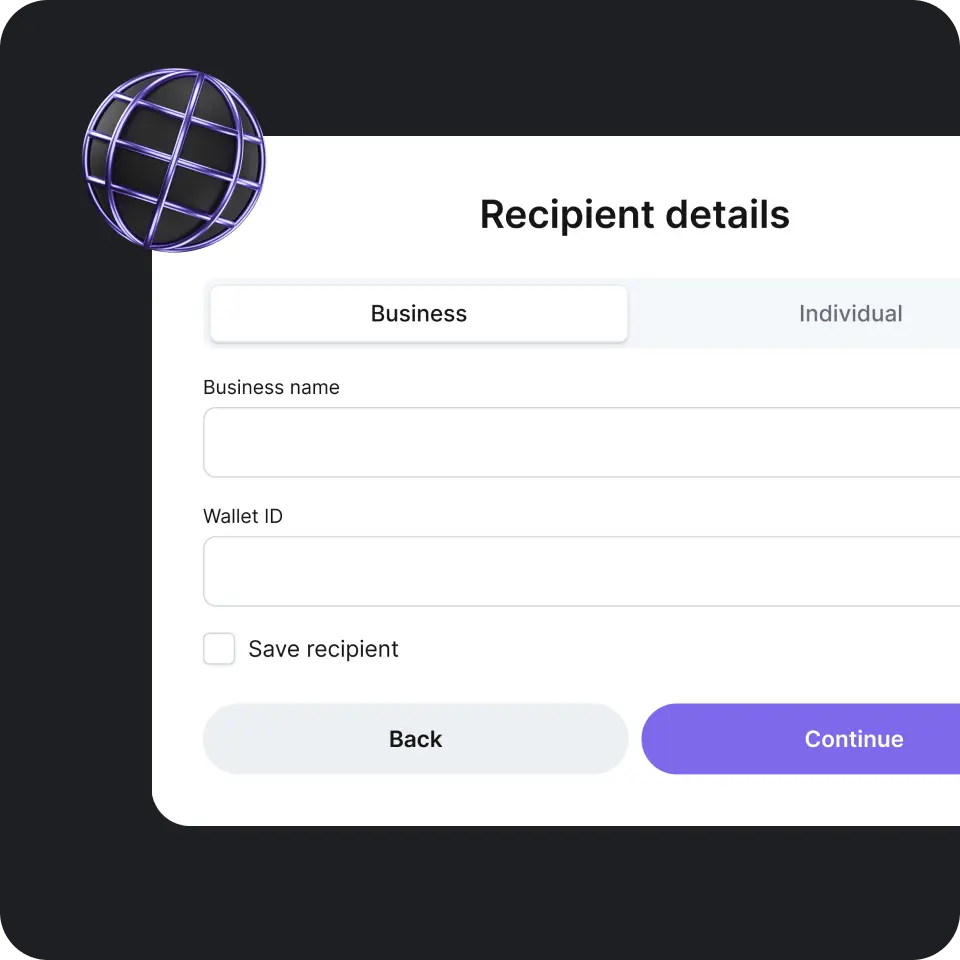

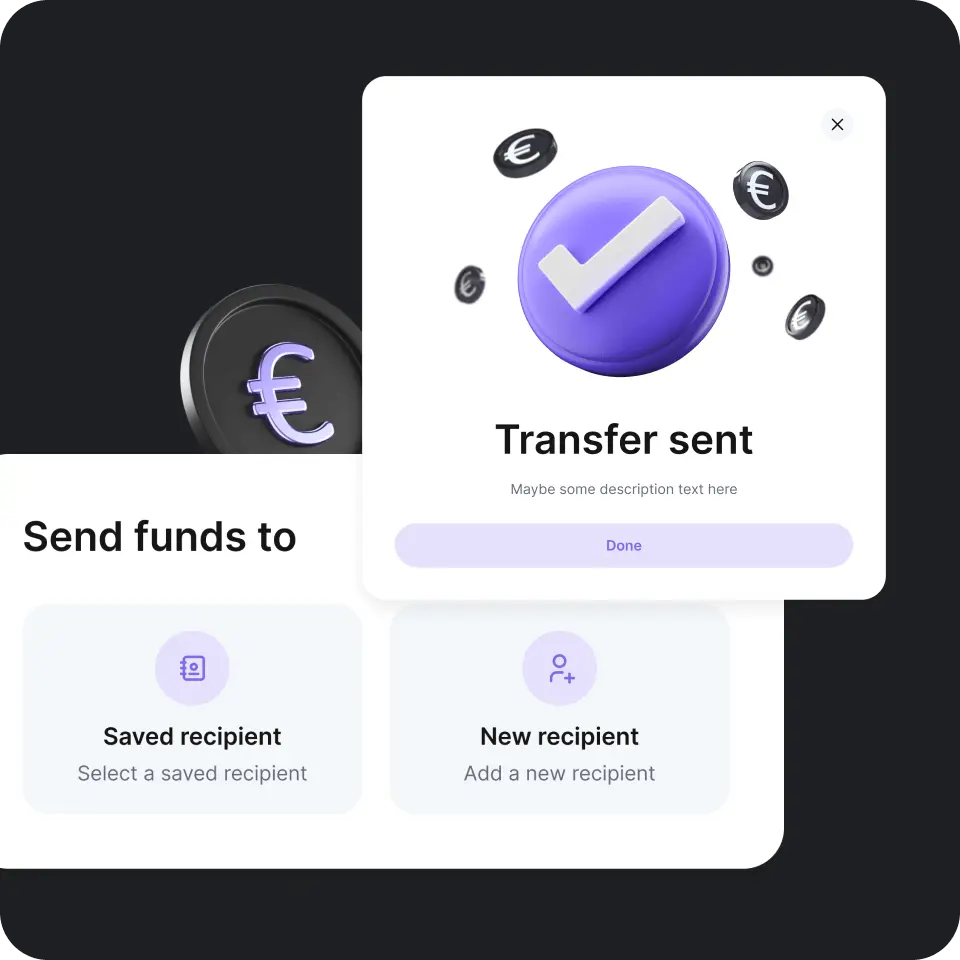

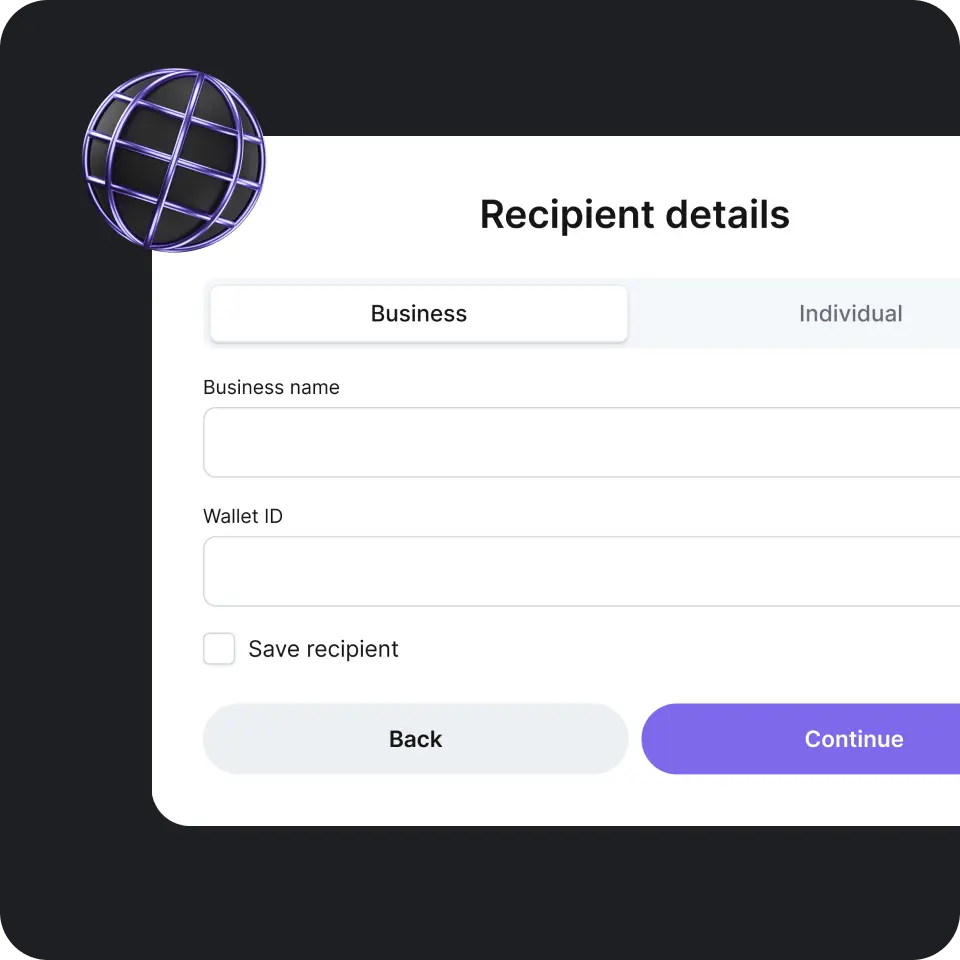

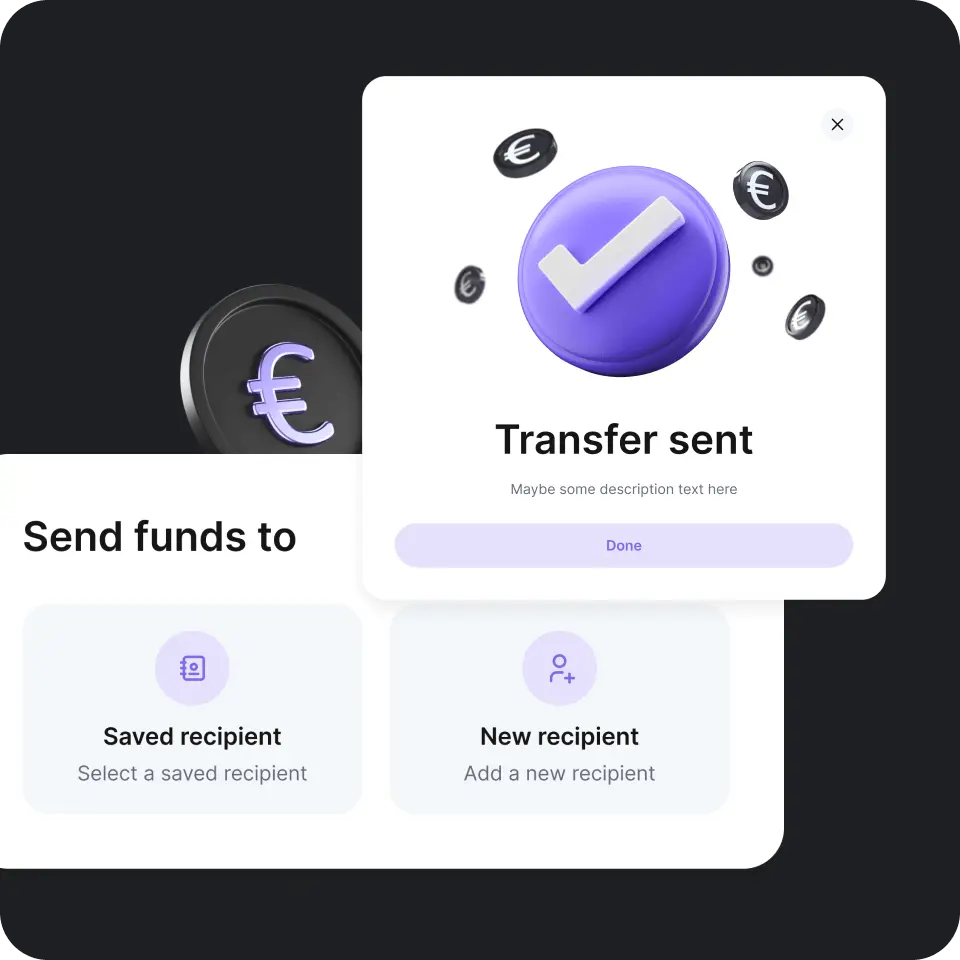

Making a SEPA bank transfer is quick and straightforward. All you need is access to online banking and the recipient’s information. The process usually takes just a few minutes:

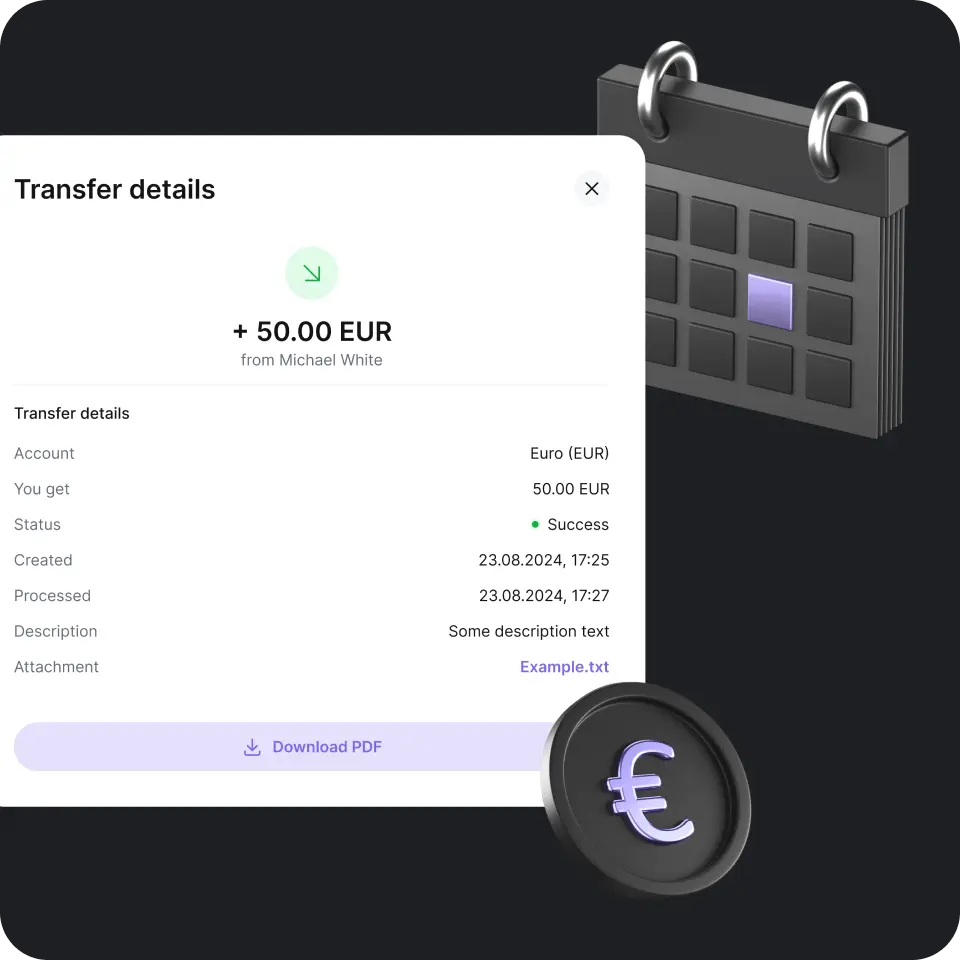

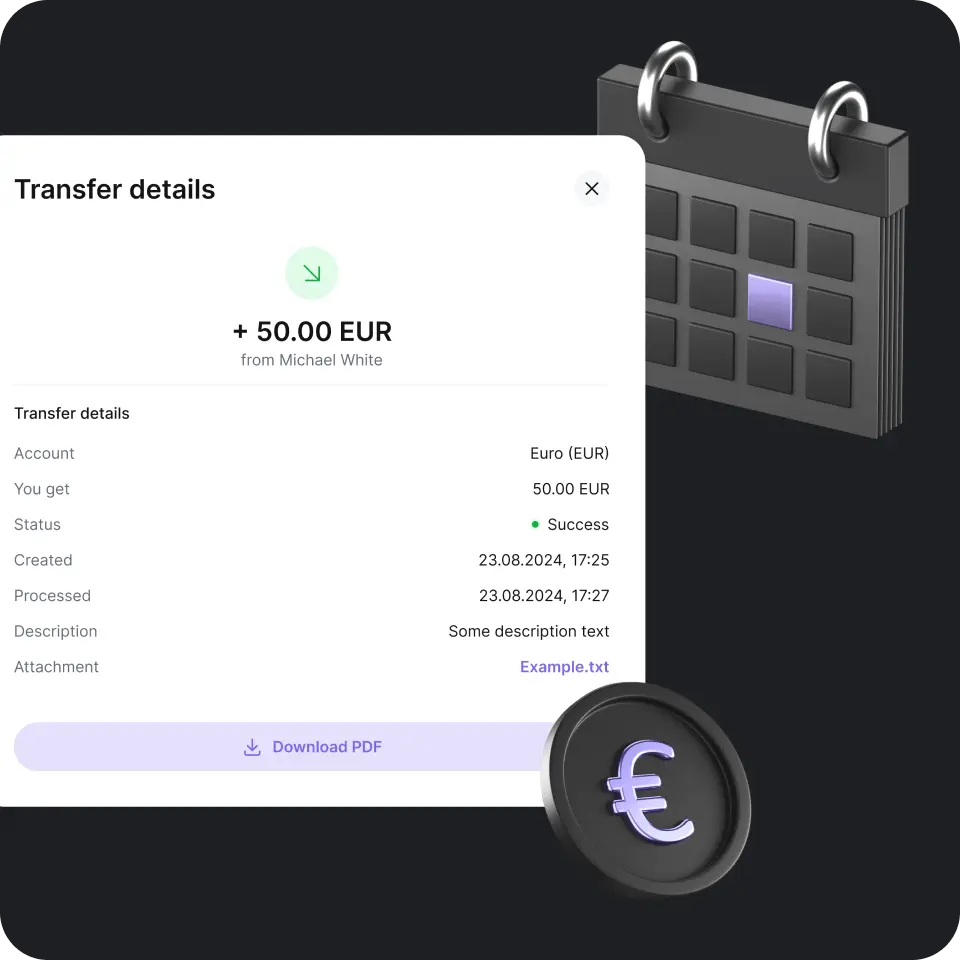

After confirmation, the money moves through the system SEPA network and reaches the recipient within one working day. It’s a safe and automated euro transfer system that offers a consistent experience across countries. For businesses, combining SEPA with other tools such as BACS payment methods can expand payment options across Europe and the UK, giving even more flexibility in managing financial operations.