Make Fast and Reliable Payments with UK Payment Systems

The UK offers three trusted systems for secure money transfers — BACS, FPS, and CHAPS. Each is designed for different payment needs, from everyday transfers to high-value transactions.

The UK offers three trusted systems for secure money transfers — BACS, FPS, and CHAPS. Each is designed for different payment needs, from everyday transfers to high-value transactions.

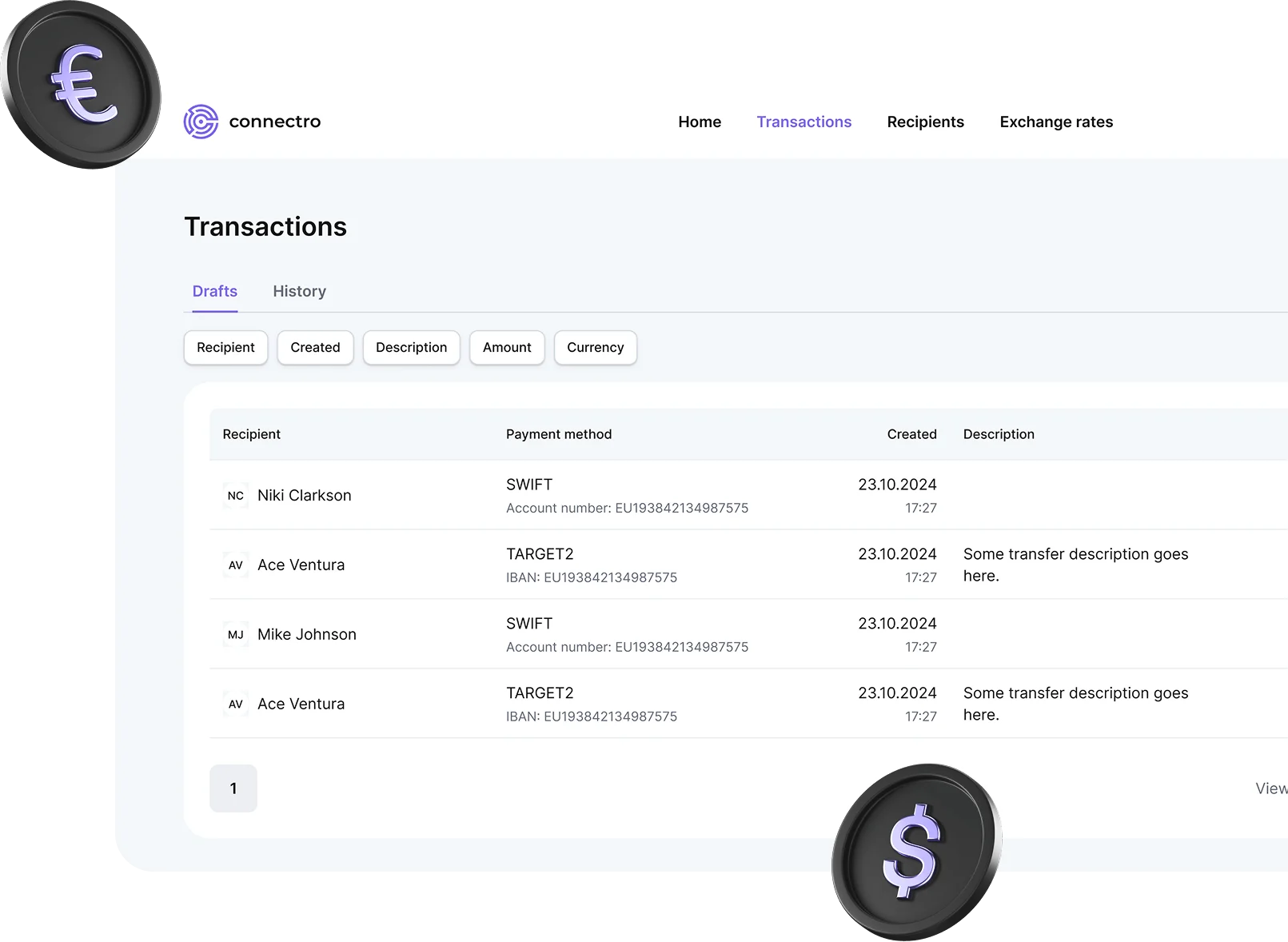

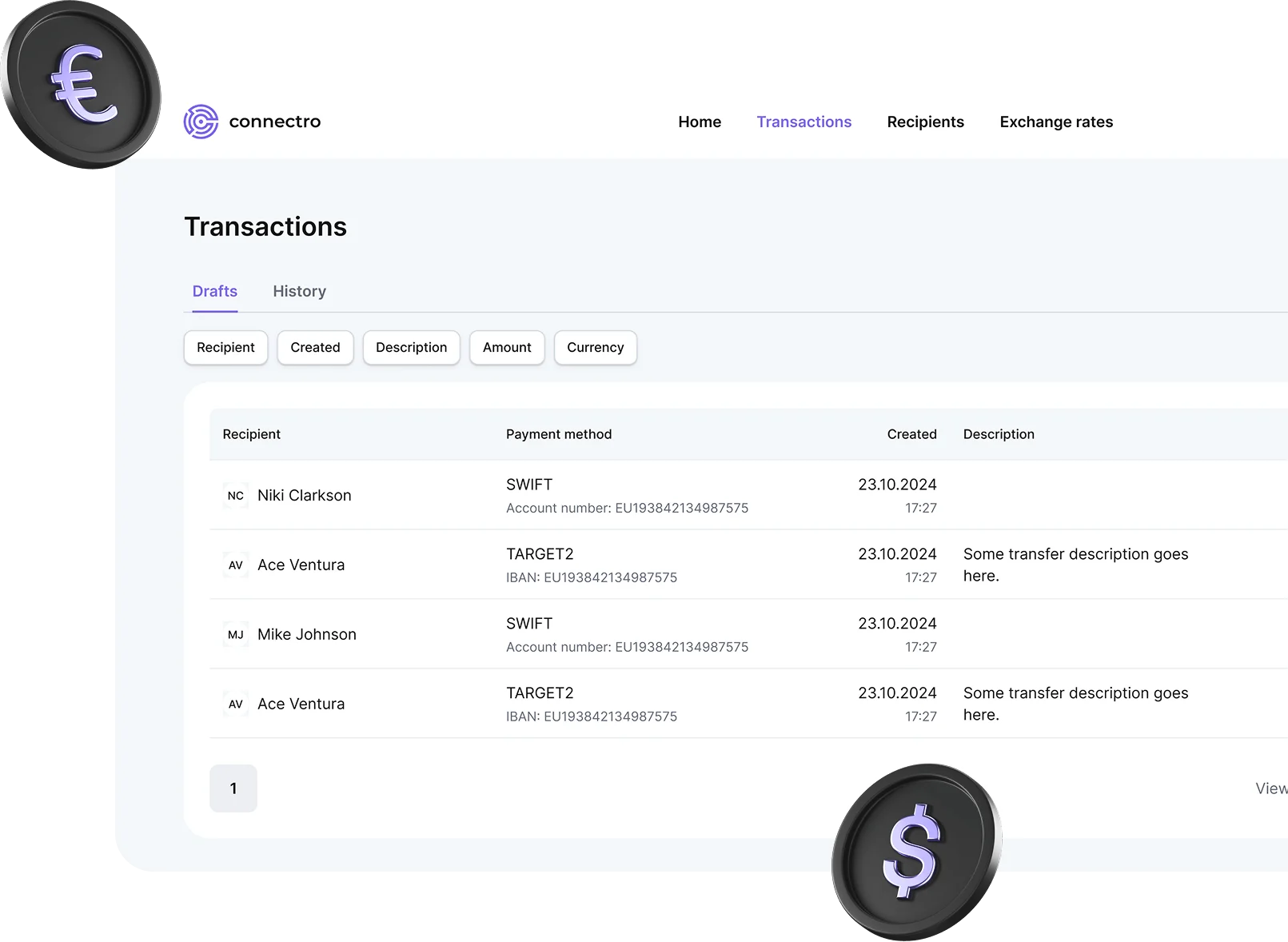

The UK payment systems consist of three main networks:

BACS transfer, FPS transfer, and CHAPS transfer.

Each system has its own purpose and advantages.

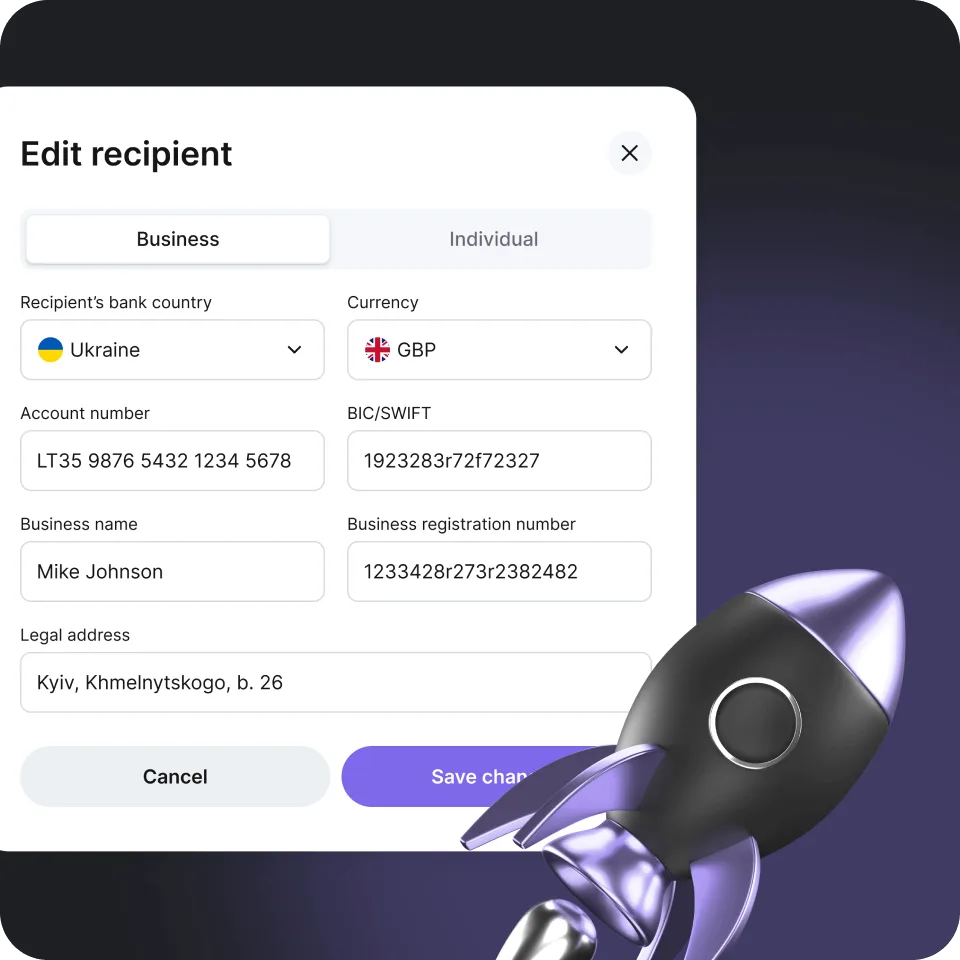

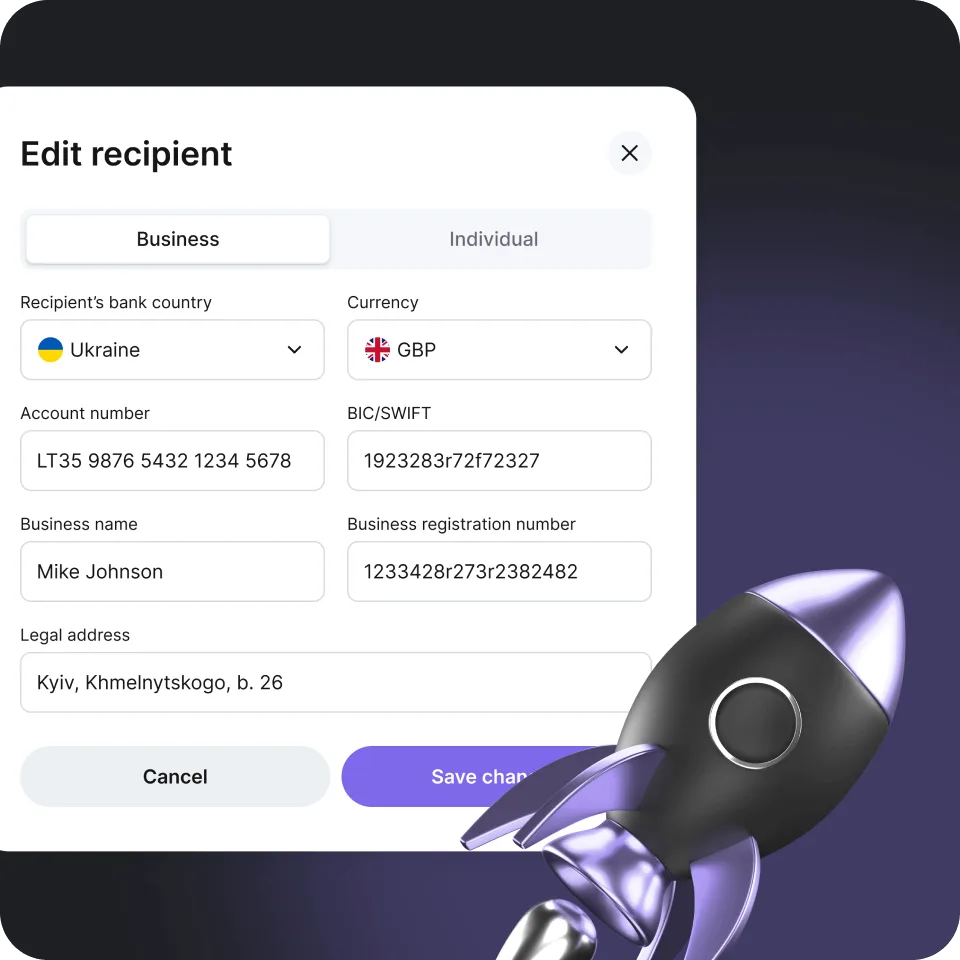

When selecting between BACS, FPS, and CHAPS, it’s worth knowing how each system benefits you. BACS payments are cost-effective and ideal for bulk processing, offering stability and predictability. FPS transfers are perfect for real-time business transactions and instant personal transfers. CHAPS transfers provide confidence when timing and certainty matter most.

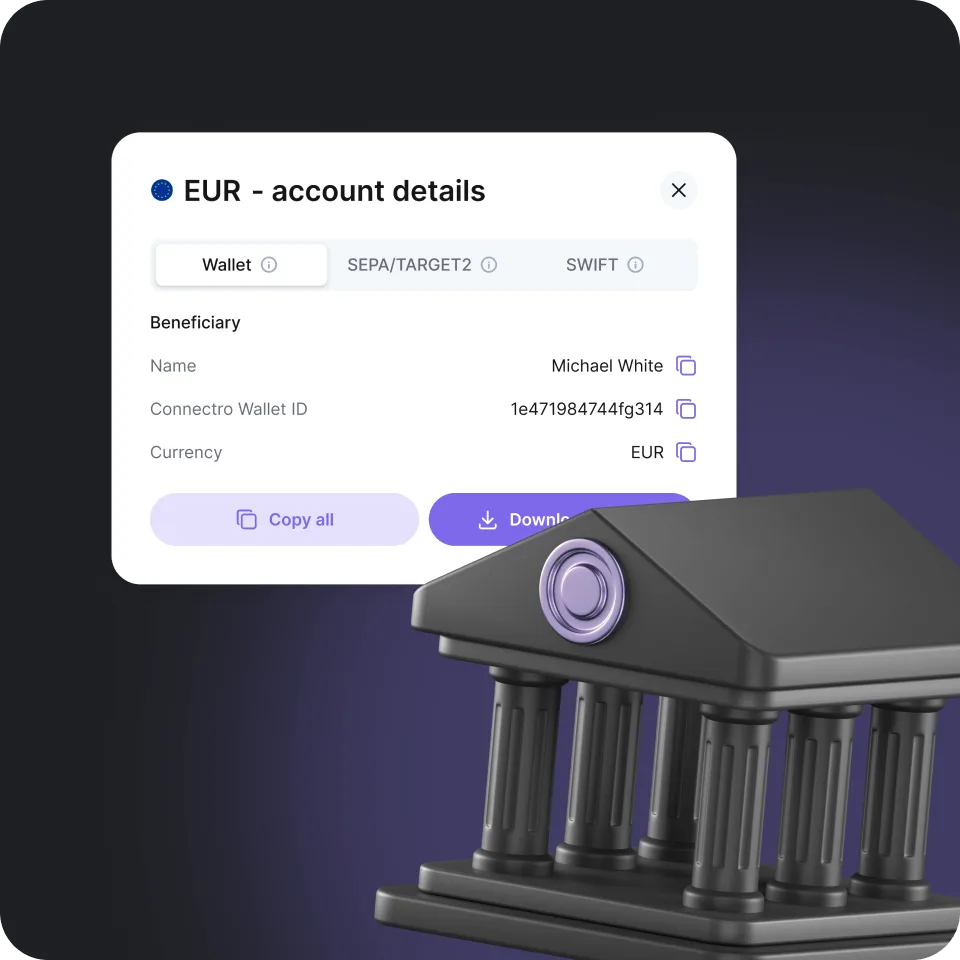

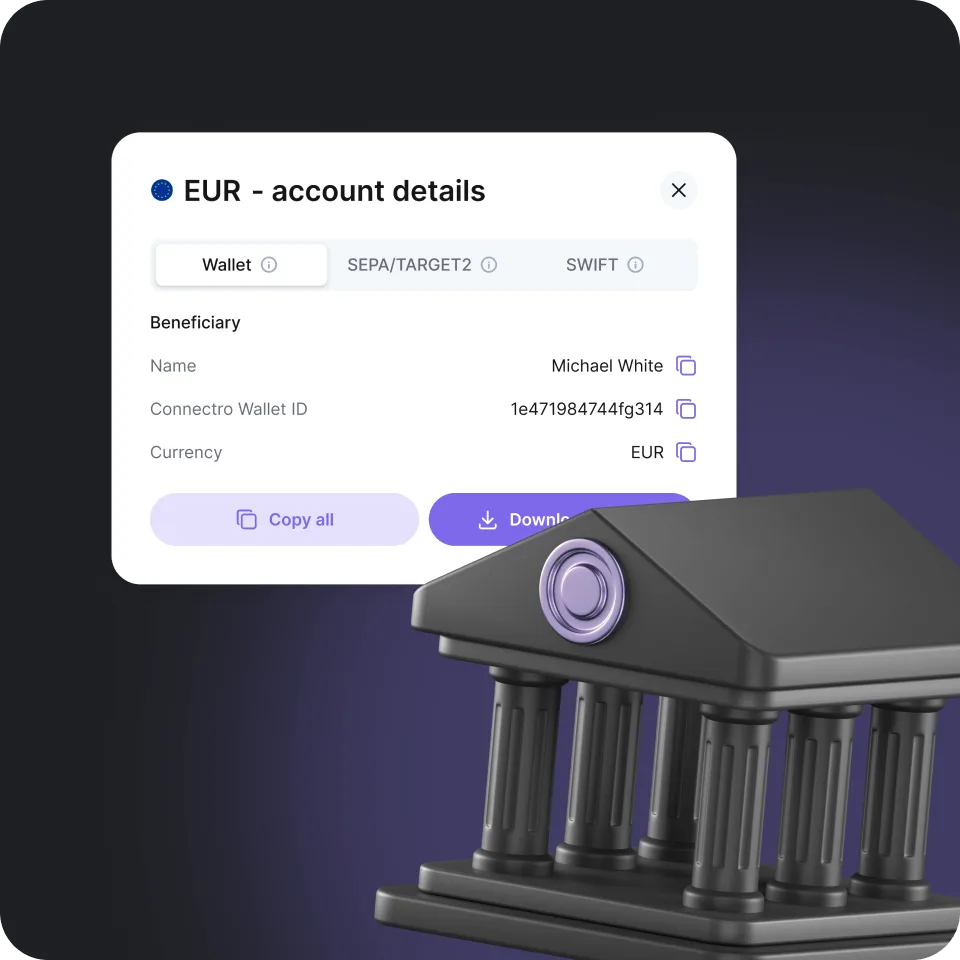

Many of our clients combine these services with SEPA transfers to manage both domestic and cross-border payments with ease.

Most banks confirm an FPS transfer within seconds. A BACS payment will show as “pending” until it clears, while a CHAPS transfer may take a few hours depending on the cut-off time. Each system offers reliable tracking options, so you can easily monitor the payment’s progress.

We also support payments for digital services, including our Crypto Exchange, where customers can securely manage crypto-to-fiat conversions alongside their standard transfers.