Send Money Worldwide via SWIFT Network

Global transfers made simple and secure with SWIFT bank transfers in USD and EUR.

Global transfers made simple and secure with SWIFT bank transfers in USD and EUR.

The SWIFT system for international transfers is a worldwide financial messaging network that connects more than 11,000 institutions across 200 countries. It allows banks to exchange payment instructions quickly and securely. When you send money abroad through SWIFT, the funds are transmitted using correspondent banks that maintain accounts with one another. These intermediaries pass messages through the SWIFT network to complete the transaction.

The system supports multi-currency payments — most often in USD and EUR — and has remained the gold standard of international banking for decades. Its reliability, global reach, and traceability make it the preferred option for cross-border transfers of every size.

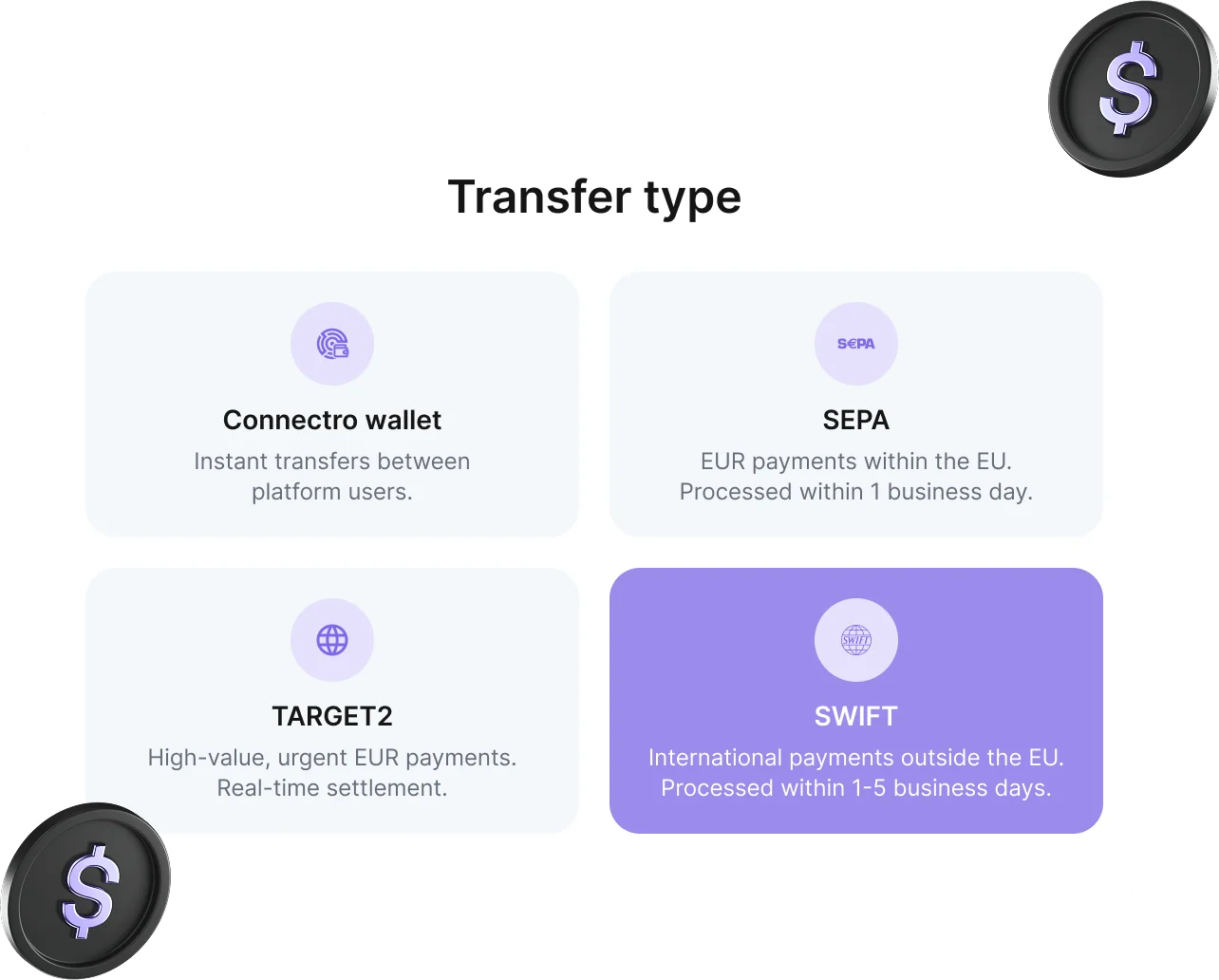

A Pooled IBAN is a shared international bank account number used by multiple clients under one financial institution. With this system, funds are automatically allocated to the correct client with no delays due to each transaction within a Pooled IBAN being uniquely identified.

Combining the Pooled IBAN with fast SWIFT payments improves the process efficiency: instead of waiting for traditional correspondent banking chains to finalize every individual account settlement, transactions are consolidated, yet remain fully transparent.

While a Pooled IBAN offers convenience and speed, some clients who prefer full account ownership and personalized reconciliation may find a dedicated IBAN account an appealing option. It provides individual account details for every client, enhancing transparency and precise control over cross-border transfers.

Using SWIFT for international transfers brings clear advantages for a secure global transfer. Transactions are recognized and accepted by financial institutions across the world, and the SWIFT format guarantees consistent accuracy. Customers appreciate the ability to send and receive funds in major currencies like USD and EUR without geographic limitations.

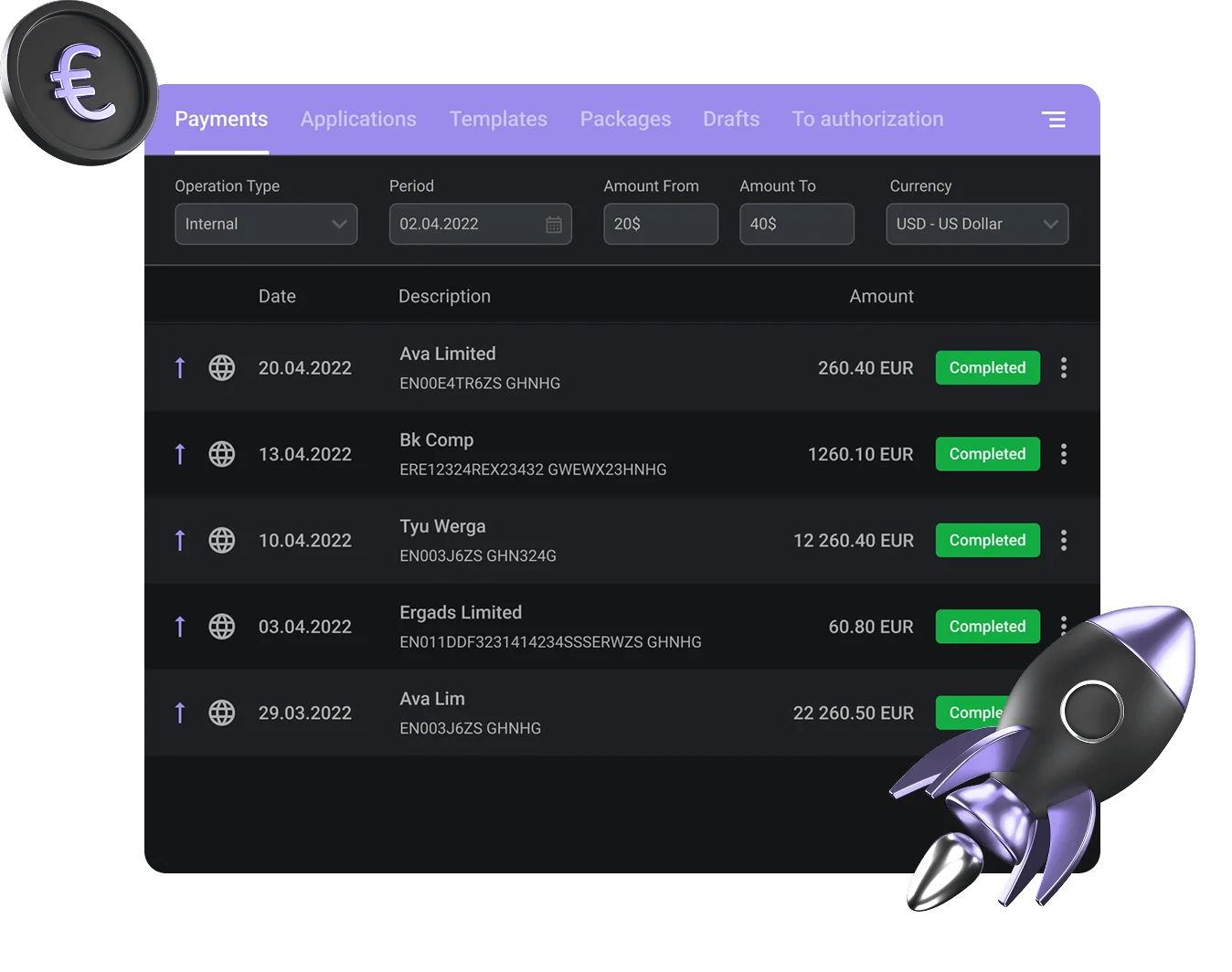

SWIFT bank transfers and SEPA bank Transfers have their benefits, but SWIFT is preferable when transferring non-Euro currencies or sending money to a country outside the SEPA zone.

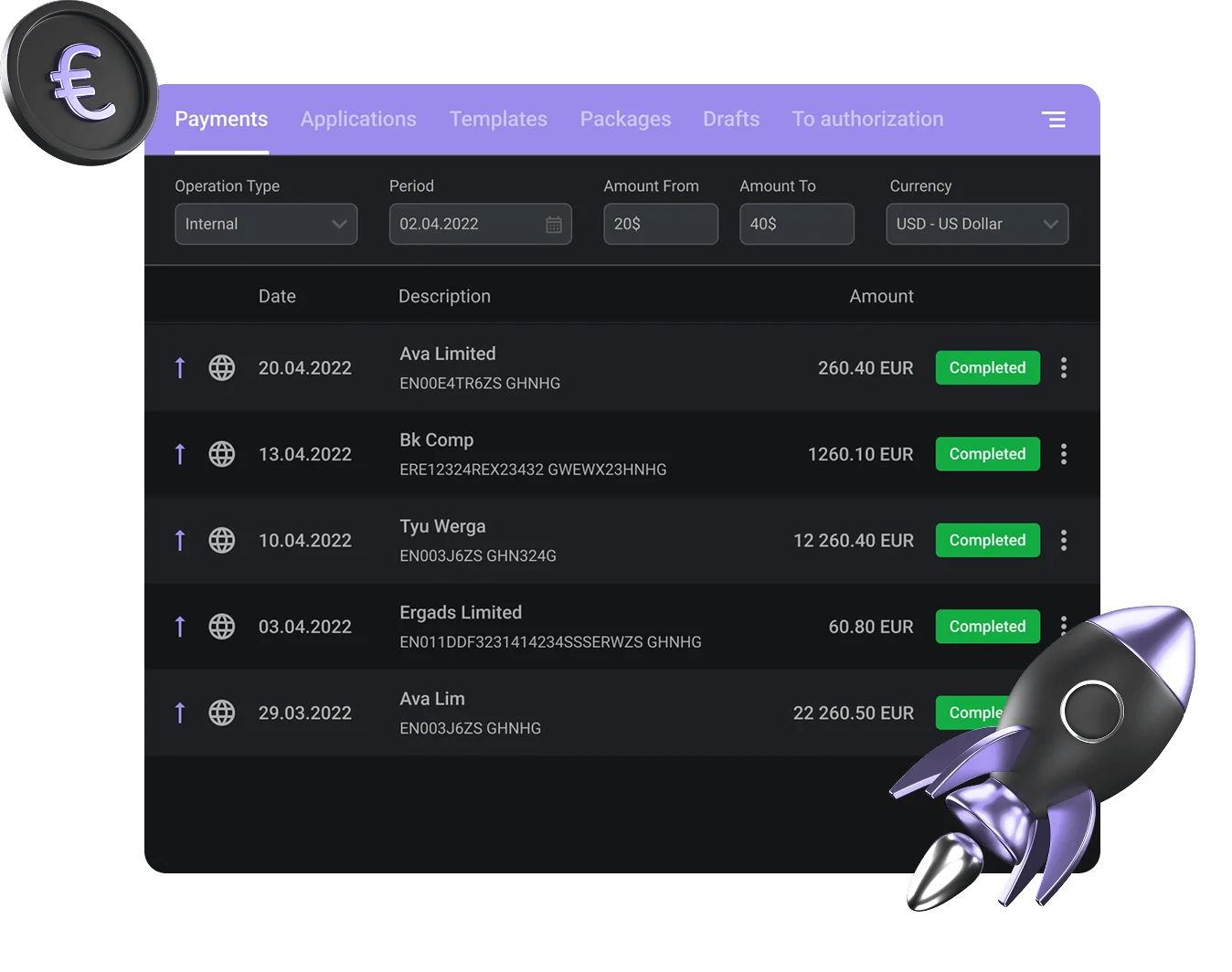

After submission, we send the payment message through the SWIFT network, and your bank works with correspondent partners to finalize delivery. You can monitor every stage of the secure global transfer from your dashboard, giving you full control over timing and confirmation.